Managing VAT rules

The next subsections describe how you can add, remove and modify the VAT charging rules from the administration interface.

Creating a VAT rule

The administration interface allows you to add new VAT charging rules to the webshop system. The following text reveals how this can be done.

Please note that it is recommended (but not required) to create static VAT types and product categories (if needed) before creating your VAT charging rules.

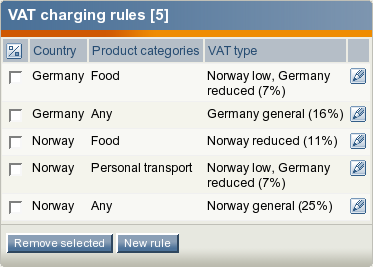

- Click the "Webshop" tab in the administration interface and select the "VAT rules" link on the left. You will be taken to the interface displaying the list of existing VAT rules as shown in the following screenshot. This interface can also be accessed by requesting "/shop/vatrules" in the URL.

The list of VAT charging rules.

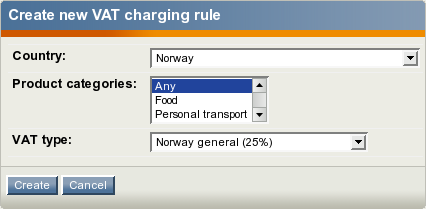

Click the "New rule" button. The system will bring up the VAT rule edit interface (look at the next screenshot).

The VAT charging rule edit interface.

Specify the desired parameters in the following way:

- Choose the desired country from the drop-down list. The VAT rule will be used for customers from this country.

- Select one or more product categories that will be affected by the VAT rule.

- Choose one of the static VAT types from the drop-down list in the bottom. The selected VAT type determines the actual VAT percentage that will be used.

- Click the "Create" button.

The new VAT rule will appear in the list as shown in the screenshot below.

The newly created VAT rule in the list of VAT charging rules.

Editing a VAT rule

The following text reveals how you can edit a VAT charging rule.

- Open the list of VAT charging rules by clicking the "Webshop" tab in the administration interface and selecting the "VAT rules" link on the left.

- Find the desired VAT rule and click the "Edit rule" button located in the same table row.

- The system will bring up the VAT rule edit interface. Specify the desired parameters and click the "Store changes" button.

Removing a VAT rule

The following text reveals how you can remove a VAT rule.

- Open the list of VAT rules by clicking the "Webshop" tab in the administration interface and selecting the "VAT rules" link on the left.

- Use the checkboxes to select the VAT rules that you wish to remove.

- Click the "Remove selected" button.

Svitlana Shatokhina (11/05/2006 12:50 pm)

Geir Arne Waaler (13/09/2010 1:52 pm)

Comments

There are no comments.